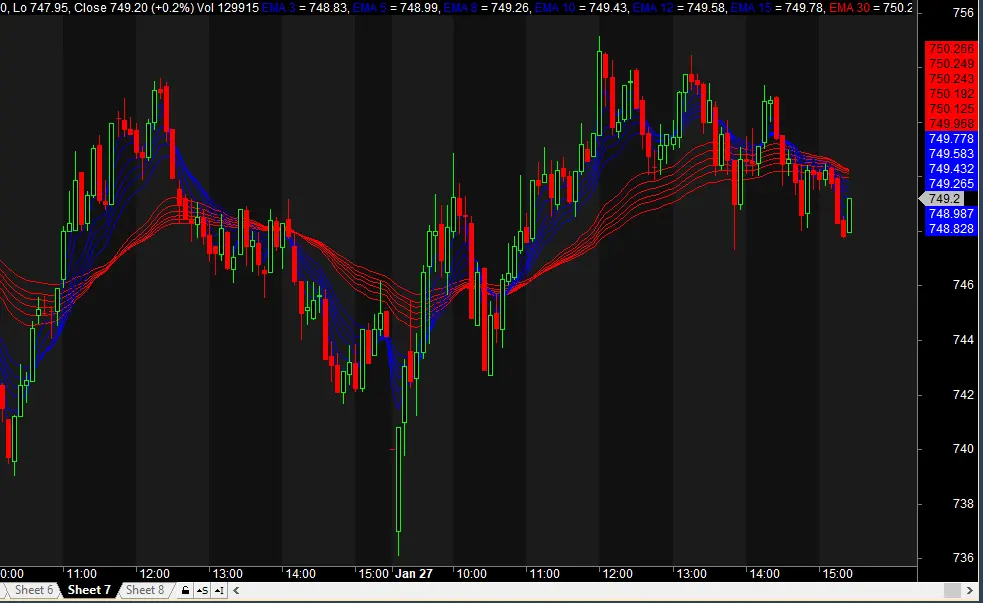

Introduction Guppy Multiple Moving Averages (GMMA) is a powerful technical analysis tool designed to assess the strength and direction of trends in financial markets. This indicator, developed by renowned trader Daryl Guppy, employs two sets of moving averages to provide insights into market trends. When applied effectively in Amibroker using the GMMA AFL (Amibroker Formula Language), traders can make informed decisions based on trend strength and momentum.

Understanding GMMA The GMMA indicator consists of two distinct groups of moving averages:

- Fast Moving Averages (Short-Term)

- Typically consists of EMA (Exponential Moving Average) values: 3, 5, 8, 10, 12, and 15.

- Represents the behavior of short-term traders.

- Reacts quickly to price movements.

- Slow Moving Averages (Long-Term)

- Typically consists of EMA values: 30, 35, 40, 45, 50, and 60.

- Represents the behavior of long-term investors.

- Provides a broader perspective on the overall market trend.

How GMMA Works GMMA is used to identify trend strength and potential reversals by analyzing the interaction between fast and slow moving averages:

- Strong Bullish Trend: When the fast moving averages are above the slow moving averages and are widely separated, it indicates strong bullish momentum.

- Strong Bearish Trend: When the fast moving averages are below the slow moving averages and are widely separated, it indicates strong bearish momentum.

- Sideways Market: When both groups of moving averages are intertwined, it suggests a consolidation phase with no clear trend direction.

Benefits of Using GMMA in Amibroker

- Trend Identification: Quickly identifies strong trends and helps traders enter at the right time.

- Risk Management: Reduces the risk of false signals by offering a multi-timeframe analysis.

- Versatility: Can be used across various timeframes, from intraday to long-term analysis.

How to Use GMMA AFL in Amibroker

- Copy and paste the above AFL code into the Amibroker formula editor.

- Save the file with a descriptive name such as “GMMA.afl.”

- Apply the AFL script to a chart by selecting the symbol and timeframe.

- Analyze the chart to identify trend strength and potential trade opportunities.

Common Mistakes to Avoid

- Ignoring Market Context: Always analyze the overall market conditions before relying solely on GMMA signals.

- Overtrading: Avoid excessive trading based on minor crossovers; look for significant trend formations.

- Failure to Adjust Settings: Customize moving average values based on asset volatility and trading style.

Conclusion Guppy Multiple Moving Averages (GMMA) is an excellent tool for trend analysis, helping traders determine market strength and direction with precision. By utilizing the provided AFL code in Amibroker, traders can effectively incorporate GMMA into their trading strategies for better decision-making and risk management.